ET Bureau

ET BureauWhile the economic slowdown has reduced the demand for consumer electronic and electrical products, the demand for products like UPS, inverters, batteries, stabilisers and solar water heaters has risen due to the ongoing power crisis. V-Guard already has 51% share of the stabiliser market. To reach the top position in solar water heaters, it has recently increased its production capacity by 90,000 units per annum by investing Rs 18 crore.

|

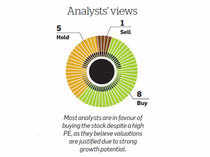

Though V-Guard may look expensive if one follows the historical PE analysis (see table), analysts believe that the higher valuation is justified because of higher growth. As per the consensus estimates, V-Guard’s revenues and net profit are expected to grow at an annualised rate of 23% and 30% respectively between 2012-13 and 2014-15. Due to factors like its strong brand in the south and faster growth in non-southern markets, strong cash flows, improving margins and diverse products, V-Guard is a good long-term bet.

Selection methodology: We choose the stock that has shown the maximum improvement in consensus analyst rating over the past month. Consensus rating is arrived at by averaging all analyst recommendations after attributing weightages to each (5 for strong buy, 4 for buy, 3 for hold, 2 for sell and 1 for strong sell). Any improvement in consensus rating indicates that analysts are becoming more bullish on the stock. To make sure that we pick only companies that are widely covered, this search will be restricted to stocks that are covered by at least 10 analysts.

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times